The Gaming Compact

In 2002, the Seneca Nation signed a Gaming Compact with the State of New York under the federal Indian Gaming Regulatory Act to establish three “Class III gaming” casino facilities in Western New York.

Since then, the Nation has invested more than $1 billion to develop three world-class gaming destinations – Seneca Niagara Resort & Casino in Niagara Falls, New York; Seneca Allegany Resort & Casino in Salamanca, New York; and Seneca Buffalo Creek Casino in downtown Buffalo, New York – that attract millions of visitors annually.

The Seneca properties are a regional economic driver, directly providing thousands of well-paying jobs to local workers – most of whom are non-Seneca – while further supporting thousands of additional local jobs through the properties’ extensive utilization of local suppliers and vendors.

Under the 2002 Compact, the Nation agreed to pay a portion of its gaming revenues to New York State in exchange for exclusivity west of State Route 14. The State, in turn, distributed a portion of those funds to local governments. Since 2002, the Nation has sent more than $1 billion in revenue share payments to the State.

At the same time, exclusivity granted to the Seneca Nation was eroded by the authorization of State-owned gaming devices at local raceways and by allowing commercial casinos located on the outskirts of the Nation’s exclusivity area to siphon off Nation casino customers and business. New York’s recent authorization of statewide mobile sports betting has continued the trend of eroding the Nation’s competitive position, this time to the benefit of large national gaming providers with no connection or responsibility to Western New York.

Upon completion of the initial Compact term and the Nation’s revenue share obligation in December 2016, the Compact automatically extended for an additional seven years, with no requirement for continued revenue share payments. The renewal did, however, contain provisions allowing either party to negotiate, prior to renewal, any amendment that they required. The State never sought to extend or renegotiate the revenue sharing provision.

In January 2017, the U.S. Department of Interior, the federal agency responsible for approving State-Tribal Compacts, confirmed in correspondence to the Seneca Nation that its obligation to make payments terminated upon the end of the initial 14-year term of the Compact and that payments beyond that date were not required. (See 2017 DOI Letter)

The Nation and the State of New York have since been involved in a dispute over these payments, with the Nation exercising its legal rights to defend its position, as supported by federal law. (SEE DOI/NIGC Letters)

The Nation has long sought to start negotiations with the State of New York to resolve this dispute and come to agreement on terms of a new Compact in advance of the current Compact’s expiration in 2023. Throughout this process, considerable misinformation and false narratives have been advanced. This website aims to set the record straight, offering visitors the truth about the Nation, its gaming operations and the Compact.

Latest Compact Developments

August 2017

Niagara Falls in Critical Condition

I am reporting live from the city of Niagara Falls, NY where I have lived my entire life. The situation here has a reached a boiling point and it is [...]

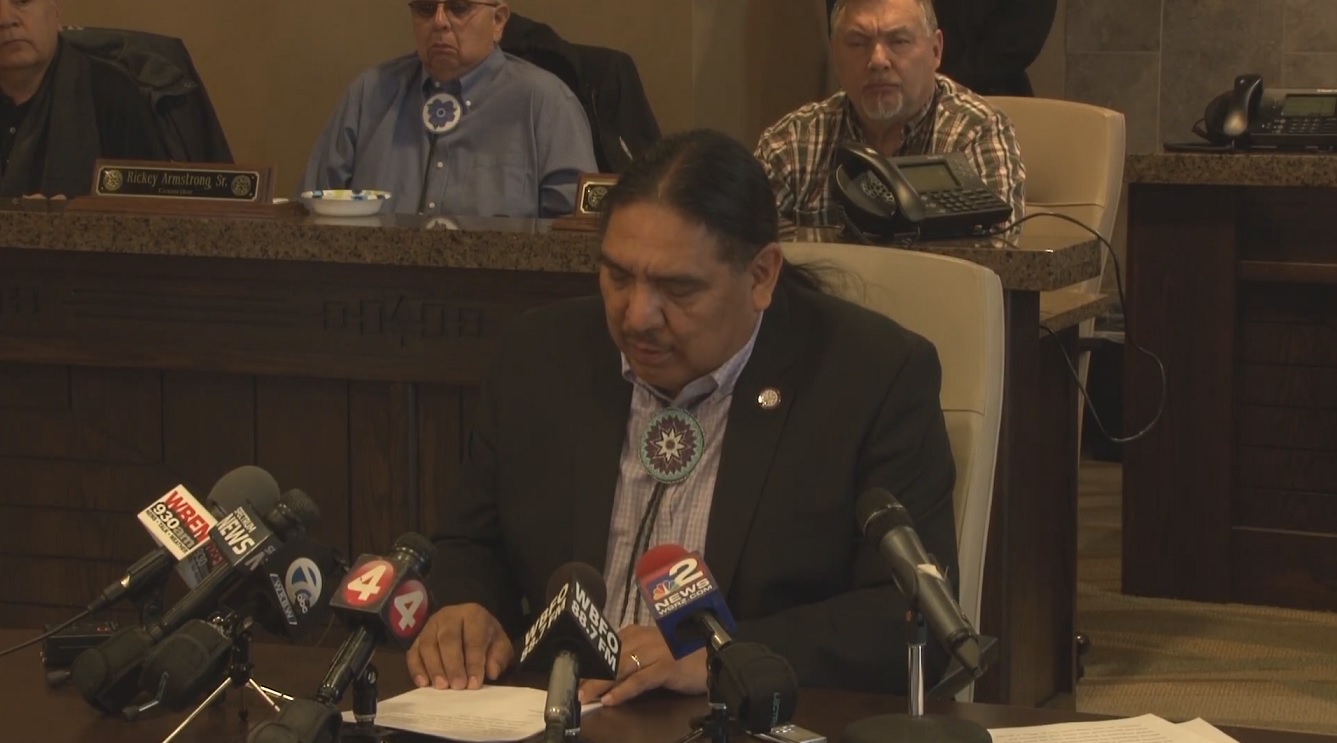

Seneca Nation Press Conference 8/22/17

President Gates briefs the press about the Seneca Nation's gaming compact with New York State and Governor Cuomo's continued cancelled meetings, threats, and slanderous comments. Attorney Dennis Vacco addresses the [...]

Another Voice: Governor ignores casino compact wording and hurts communities

For all his rhetoric, brashness and tough-guy image, Gov. Andrew M. Cuomo is picking a fight he cannot win and he is hurting local communities as he mounts his war [...]

Seneca Nation Council Statement on Revenue Sharing and Meeting with Governor Cuomo

The Council of the Seneca Nation is completely united on the Nation's position on revenue sharing with the New York State: It's over! Unlike the current personnel in the governor's [...]

July 2017

Still no meeting between state, Senecas

BUFFALO, N.Y. - There still isn't a meeting scheduled between the Seneca Nation of Indians and New York state to talk about casino revenue. As part of a gaming compact, [...]

Letter: Seneca Nation dedicated to being a good neighbor

Since Independence Day is here, I thought it appropriate to recognize the contribution of Seneca Nation men and women who have served with great distinction in the armed forces of [...]

June 2017

Guest View: The 10-5 Plan for Niagara Falls

The City of Niagara Falls is in trouble. We’ve enjoyed inflows of “casino cash,” but instead of using that money on projects that are enduring, we’ve used it to plug [...]

May 2017

Guest View: Seneca Nation is vital to success of Falls community

Instead of wasting time debating the terms of the New York State Gaming Compact, our local government should be working with the Seneca Nation to be good neighbors and continue [...]

Seneca Nation officials talk with Salamanca council

Maurice A. John Sr., treasurer of the Seneca Nation of Indians, and Nation council members on Wednesday night discussed with Salamanca community members future relations between the city and the [...]

April 2017

Letter: Many workers have benefited from Seneca Nation projects

Regardless of the recent developments between the Seneca Nation of Indians and New York State, what I can personally attest to is the economic benefit the Seneca Nation has had [...]

National Indian Gaming group supports Senecas on compact

The National Indian Gaming Association (NIGA) recently passed a resolution supporting the Seneca Nation as the nation completes its 14-year commitment to share gaming revenues with New York state. The [...]

Upstate NY Casino News: Tourists lured by del Lago; fine-tuning Rivers; lit up in Buffalo

The new del Lago Resort & Casino near Waterloo seems to be boosting tourism in Seneca County. Almost a quarter of the visitors staying at Seneca County hotels in the [...]

The Seneca Nation Casinos: Working for the Nation and Its Neighbors

Final payment of the Seneca Nation compact with New York has been made, but being a good neighbor to the communities is ongoing. The Seneca Nation casinos are a proven [...]

Team Cuomo’s Latest Casino Fiasco

From the time of the Dutch purchase of Manhattan, Native Americans have gotten one raw deal after another. So imagine the delight of the Seneca Nation of Indians’ tribal leaders [...]

March 2017

Seneca Nation Press Conference 3/23/17 – Re: Gaming Compact

President Todd Gates speaking at the Cattaraugus Territory Council Chambers to the media about the expiration of the 14 year revenue sharing agreement between the Seneca Nation and the State [...]